![Rosenheim Advisors: Food Tech & Media Industry 2016]()

This is a guest post written by consulting firm Rosenheim Advisors; it highlights the most interesting acquisitions, financings and partnerships within the Food Tech & Media ecosystem – digital content, social, local, mobile, grocery, e-commerce, delivery, ordering, payments, marketing and analytics – to give you insights into the latest funding and growth trends.

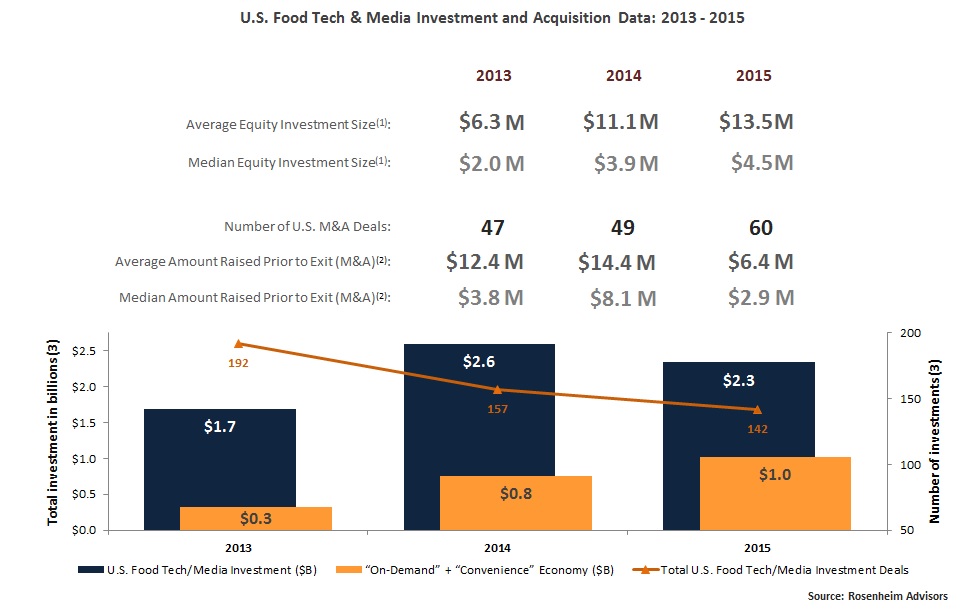

While there were a number of interesting deals this summer, overall activity was relatively light. The last three months brought in approximately $758 million in funding for 51 private companies across the global food tech sector, broken down into $165 million, $170 million and $423 million for June, July and August, respectively.

Year-over-year the number of funded companies during this 3-month period was down 21% while total funding dollars were down 56%. Excluding later-stage deals from the data ($100+ million), the average funding amount per deal during the three month period was ~$8 million versus ~$14 million the previous year.

There was a clear narrative around organic, clean eating and health, with half of the acquisitions in this category and a third of the funding dollars supporting the theme. Building upon that, the online grocery sector dominated the headlines this summer with a variety of cash infusions, consolidation, and rebirth. The delivery category (which includes grocery) continues to maintain momentum representing 80% of the capital and over half of the deals during the three months.

Year to date (tracking the first eight months of the year), overall M&A activity was down by about 18% versus the same period last year, a trend which was definitely reflected this summer as there were no M&A deals in July and only eleven deals in June and August (versus 21 during the same 3-month period last year).

Perhaps reflecting a shift in corporate strategy towards investment over full-on acquisition, there have been a number of strategic investments in recent months. For example, while Yelp has made five acquisitions to build out its platform, it decided to make its first and only (publicly announced) strategic investment in NoWait this summer.

Among the various global food/restaurant ordering rollups, there were a couple of geographic deals in play as Takeaway.com scooped up Just Eat’s and Netherland/Belgium operations, Foodpanda merged hellofood with Hungerstation in Saudi Arabia, and ifood was further funded by Just Eat and Movile to expand deeper into Mexico. Separately, a new acquirer in the U.S. online grocery space, Direct Eats, made two acquisitions since May, promoting speculation that it may continue to acquire smaller regional players for scale.

M&A

Direct Eats Acquires Wholeshare. The San Francisco, CA-based sustainable and organic foods online marketplace will augment Direct Eats’ customer base. While Wholeshare was able to build a strong offering and loyal customer base, the company struggled to scale. Wholeshare is the second acquisition for Direct Eats this year, as the company acquired Abe’s Market, a similar online marketplace, in May.

Announced: 08/29/16 Terms: Not Disclosed Previous Investment: $2.0m Founded: 2009

Waitr Acquires Requested. The Sacramento, CA-based restaurant booking app will provide Waitr, a Lake Charles, LA-based restaurant management system focused on delivery/takeout service, with in-restaurant dining and booking options. According to Street Fight, Requested’s key innovation is a “dynamic pricing system that allows restaurants to offer deals and negotiate directly with customers on slow day”. Waitr will incorporate these elements into its present, flat-rate restaurant delivery app. Currently, Waitr operates in over 1,000 cities, and will expand to Roseville, CA with the acquisition. In addition, Requested’s team will continue in Sacramento, while co-founder Sonny Mayugba will become Waitr’s chief marketing officer.

Announced: 08/26/16 Terms: Not Disclosed Previous Investment: Not Disclosed Founded: 2014

Tripadvisor Acquires CityMaps. The New York, NY-based map app will allow Tripadvisor to enhance its mobile map features and deepen its location-based activities marketing. CityMaps functions as a travel guide within a real-time navigation map app where users are able to view restaurants, attractions, and events around them, and create a personalized map based on their interests. With the acquisition, CityMaps will continue as a standalone business.

Announced: 08/26/16 Terms: Not Disclosed Previous Investment: $12.0m Founded: November 2010

Hooch Acquires Tipsy. The Tempe, AZ based nightlife app offers discounted drinks and other perks to members, with over one third of their premium members being active subscribers for over a year. According to Phoenix Business Journal, in addition the userbase, Tipsy has a venue dashboard Hooch is interested in taking advantage of.

Announced: 08/25/16 Terms: Not Disclosed Previous Investment: None Founded: 2015

Cooked Chicago Acquires Chefmade. The Chicago, IL-based meal delivery services will join to offer weekly meal delivery. Both companies provide consumers with a menu from which they can select meals for the week. Deliveries are made once a week. Cooked will continue to offer Chefmade meals as menu options along with their own menu items. In addition, half of Chefmade’s team will join Cooked, and co-founder Sarah Arel will become Cooked’s director of creative growth.

Announced: 08/24/16 Terms: Not Disclosed Previous Investment: Not Disclosed Founded: 2015

Foodpanda Acquires Hungerstation, Merges it with Hellofood. The Ad Damman, Saudi Arabia-based online platform for meal ordering and delivery will allow FoodPanda, Rocket Internet’s on-demand food delivery company, to expand its current Middle East operations (Hellofood). Foodpanda also operates two other food delivery companies in the region– 24h in the UAE, and Otlob in Egypt. Together, the combined company will reach 2000 restaurants in 30 cities. HungerStation will continue standalone operations.

Announced: 08/09/16 Terms: Not Disclosed Previous Investment: Not Disclosed Founded: March 2012

Takeaway.com Acquires JustEat’s Netherlands and Belgium operations. The London, UK-based online meal ordering service has sold its Belgium and Netherlands businesses to Takeaway.com. an Amsterdam, Netherlands-based online meal delivery service. The deal was priced at €22.5 million ($25.3 million USD). Just Eat sold the businesses due to less profitability in those countries and will focus on its other operations. This comes as Takeaway.com is gearing up for an IPO in September, potentially valuing the company at over a billion dollars.

Announced: 08/02/16 Terms: $25.3m Previous Investment: $89.0m Founded: October 2000

PaidEasy Acquires Happy Any Hour. The New York–based mobile app, which helps bars and restaurants solve excess capacity through time-based, localized happy hours, was acquired by PaidEasy, a New York-based mobile payment app for restaurants. As TechCrunch reports, the new product and technology will add “an element of discovery” to the PaidEasy platform.

Announced: 08/02/16 Terms: Not Disclosed (Cash and Stock) Previous Investment: Not Disclosed Founded: November 2014

Door to Door Organics Merges with Relay Foods. The Louisville, CO-based Door to Door Organics will merge with the Charlottesville, VA-based Relay foods to create an online grocery store delivering to 63 markets in 18 states, focused on natural, organic and locally sourced products. The company will maintain offices in Louisville and Charlottesville and will continue to operate as separate, customer-facing businesses until the integration is complete; the new brand is expected to be announced later this year. The merger also includes a $10 million equity financing deal from The Arlon Group (a previous Door to Door Organics investor).

Announced: 06/08/16 Terms: Not Disclosed Previous Investment: Door to Door Organics – $38.8m; Relay Foods – $13.3m Founded: Door to Door Organics – 1997; Relay Foods – 2007

Jugnoo Acquires SabKuchFresh. The Chandigarh, India-based fresh produce delivery startup will allow Jugnoo, a Chandigarh-based ride hailing app, to expand its grocery delivery options and improve logistics, and quality of the deliveries. SabKuchFresh has a relationship with over 100 farmers and has built a network of B2B and B2C users. Earlier this year Jugnoo relaunched its hyperlocal grocery delivery business ‘Fatafat’ in a bid to strengthen and diversify its delivery business. Jugnoo plans to expand delivery to Guragon in the next month and 30 other cities in the next year.

Announced: 06/01/16 Terms: Not Disclosed Previous Investment: Not Disclosed Founded: 2013

Direct Eats Acquires Abe’s Market. The Chicago-based natural foods marketplace will expand the brand offering and userbase for relative newcomer Direct Eats, which is focused on building a leading ecommerce venture featuring better-for-you products in both the food and health and beauty categories. Abe’s Market will be rebranded as Direct Eats, moving the new website and platform. In contrast to competitor Thrive Market, Direct Eats does not charge shipping and does not require a membership fee.

Announced: 05/18/16 Terms: Not Disclosed Previous Investment: $19.1 million Founded: 2009

FUNDING

FoodByUs Raises $2m. The Sydney, Australia-based online platform allows users to buy and sell local, homemade foods. Home cooks can apply to be makers on the platform, which allows them to sell their food products with business and ecommerce support from FoodByUs. Consumers can view items listed by makers on the platform and place orders, which can be picked up or delivered. Since launching in August, the company has 80 makers offering 500 meals. FoodByUs will use the funds for marketing and sales. The company also plans to expand to other cities in Australia.

Announced: 08/31/16 Stage: Venture Participating Institutional Investors: Kadima Group Previous Investment: Not Disclosed Founded: February 2016

Velocity Raises $22.5m. The London, UK-based digital restaurant booking and payment platform is focused on premium restaurants worldwide. The app can also be used for payment at the restaurants. Velocity currently operates in London, New York, Miami, Los Angeles, and San Francisco. The company has made three acquisitions thus far and plans to use the investment to expand to 29 cities by 2020.

Announced: 08/29/16 Stage: Series B Participating Institutional Investors: DIG Investments (lead) Previous Investment: $16.4 million Founded: April 2014

Runnr Raises $7m. The Bangalore, India-based online delivery platform allows consumers to order restaurant meals for on-demand delivery. The company is the merged product of Roadrunnr and TinyOwl. Runnr currently operates in Bangalore and Mumbai, with plans to open in Delhi.

Announced: 08/29/16 Stage: Series A Participating Institutional Investors: Blume Ventures, Nexus Venture Partners Previous Investment: Not Disclosed (formed via merger) Founded: February 2015

HappyFresh Raises Undisclosed Funding. The Jakarta Pusat, Indonesia-based online grocery store allows consumers to order groceries for on-demand, under an hour delivery. HappyFresh shoppers shop and make deliveries, while consumers can track the status of their delivery from the HappyFresh app. HappyFresh has closed its operations in Taiwan and the Philippines, but continues to operate in Indonesia, Malaysia, and Thailand. The funding amount remains undisclosed, but is larger than HappyFresh’s $12 million Series A funding round from last year.

Announced: 08/29/16 Stage: Series B Participating Institutional Investors: Samena Capital (lead), Sinar Mas Digital Ventures, Vertex Ventures Previous Investment: $12.0 million Founded: October 2014

Vivanda Raises Undisclosed Funding. The Baltimore, MD-based technology company, which was founded by group of McCormick employees and partners then spun out in 2014, uses FlavorPrint technology to create personalized flavor profiles based on a person’s preferences for different tastes, flavors, and textures. Companies can use the technology to understand consumers’ preferences and create personalized web content based on their preferences. Customers such as Serious Eats already use the platform to help analyze recipes. Notably, this strategic investment comes from software multinational SAP, which states the investment will “further enable food companies using solutions enabled by SAP HANA to leverage the FlavorPrint technology and data collected to engage and connect with consumers in more personalized and relevant ways”. Vivanda will use the investment for growth, including hiring, and aims to double its customers in the next 6 months.

Announced: 08/26/16 Stage: Seed Participating Institutional Investors: SAP Previous Investment: Not Disclosed (Spun out of McCormick) Founded: December 2014

Prepd Raises $2.78m. The San Francisco, CA-based company launched a successful Kickstarter campaign to create a lunchbox and mobile app pair which helps consumers eat healthily and track calorie and nutrient intake. Users prepare recipes from the app, which are designed to fit perfectly in the lunchbox. They can then use the app to record their exact intake and use their compiled personal data points to manage their health and weight.

Announced: 08/24/16 Stage: Crowdfunding Participating Institutional Investors: Not Disclosed Previous Investment: Not Disclosed Founded: 2016

Zzungry Raises Undisclosed Funding. The Bangalore, India-based online restaurant allows consumers to order chef-made Indian food for on-demand delivery. Zzungry operates out of 6 kitchens in Bangalore and changes its menu offerings weekly. At present, Zzungry delivers over 150 orders per day. The investment will be used for expansion and new kitchens, building revenue channels, and marketing.

Announced: 08/22/16 Stage: Seed Participating Institutional Investors: Madhusudhan Jujare, Satish Vasudeva Previous Investment: Not Disclosed Founded: August 2015

Sample6 Raises $12.7m. The Cambridge, MA-based synthetic biology company uses its technology to detect unwanted and harmful bacteria in food. Their Listeria detector uses light and an illumination box to reveal contaminated bioparticles in food products. The detectors are simple to use and fast-detecting, with results in 6 hours. The investment will be used to expand technology to include detection of Salmonella and E coli. In addition, with the investment, Acre Venture partner Sam Kass will join the Sample6 board of directors.

Announced: 08/22/16 Stage: Series C Participating Institutional Investors: Acre Venture Partners (lead), Cultivian Sandbox Ventures, Canaan Partners, Valley Oak Investments Previous Investment: $14.8 million Founded: March 2013

Announced: 08/18/16 Stage: Seed Participating Institutional Investors: Andy Murray Previous Investment: Not Disclosed Founded: January 2014

Zero Cater Raises $4.1m. The San Francisco, CA-based catering service deliver meals to office employee groups. Meals can be ordered from local chefs, restaurants, and food trucks. ZeroCater currently operates in the San Francisco Bay Area, New York City, Chicago, Washington, DC, and Austin, serving over 1,000 companies tens of thousands of meals each day. The funding will be used to expand product and engineering teams.

Announced: 08/17/16 Stage: Series A Participating Institutional Investors: Romulus Capital (lead), Struck Capital Previous Investment: $1.5 million Founded: 2009

Glovo Raises $5.6m. The Barcelona, Spain-based mobile app operates similarly to Postmates and Jinn. Consumers can use the app to order any item available in their city for on-demand delivery in under one hour. Users can place their order, track the status of their order, and rate service following delivery. Glovo currently has over 300 partners and 200,000 users. The investment will be used to consolidate the company’s presence in Spain.

Announced: 08/11/16 Stage: Series A Participating Institutional Investors: Caixa Capital Risc, Bonsai Venture Capital SCR, Entrée Capital, Seaya Ventures, Antai Venture Builder Previous Investment: $2.3 million Founded: March 2015

Nowait Raises $8m. The Pittsburgh, PA-based mobile app allows users to get in line at restaurants before arriving. Users can view wait times and join waitlists from the app; the app notifies them when their table is ready. Nowait operates in 4,000 restaurants in all 50 US States. The strategic investment from Yelp will expand Yelp’s restaurant platform capabilities and make Nowait reservations available directly from restaurants’ Yelp pages.

Announced: 08/11/16 Stage: Growth Participating Institutional Investors: Yelp Previous Investment: $14.0 million Founded: 2010

9KaCha Raises $10m. The China-based mobile app uses label recognition to provide users with information about their wine. Users take a picture of their wine bottle’s label, upload it on the app, and then receive information. The investment from Haier will incorporate 9KaCha’s recognition technology into Haier’s new smart wine cabinet. The cabinet will adapt conditions to the type of wine being stored.

Announced: 08/11/16 Stage: Series A Participating Institutional Investors: Haier Previous Investment: $1.8 million Founded: 2012

Fruitday Raises $15m. The Shanghai, China-based ecommerce company for produce offers imported fruit for purchase. The company has visions of becoming a broader ecommerce platform for fresh food, and as such, according to Produce Report, in addition to the funding announcement, the company Fruitday declared that it would form a strategic cooperation with Lactalis, which is one of the biggest dairy companies in the world.

Announced: 08/09/16 Stage: Series D Participating Institutional Investors: Zhangjiang Hi-Tech Park Fund Previous Investment: $80 -$100 million Founded: 2009

Deliveroo Raises $275m. The London, UK-based meal delivery service allows consumers to order meals from restaurants for on-demand delivery. Deliveroo currently operates in 12 countries in Europe, Asia, and the Middle East. Its competitors include UberEats, Just Eat, and Delivery Hero. The company will use the investment for expansion and new services, such as alcohol delivery and RooBox—a service that provides delivery-only kitchens for restaurants.

Announced: 08/05/16 Valuation: Over $1 billion Stage: Series E Participating Institutional Investors: Bridgepoint (lead), DST Global (lead), General Catalyst Partners (lead), Felix Capital, Greenoaks Capital, Nokia Growth Partners Previous Investment: $199.6 million Founded: February 2013

GrubMarket Raises $20m. The Newark, CA-based online farmers market allows consumers to order organic, fresh food for delivery. GrubMarket offers meats, fish, and produce directly from farmers. Bulk ordering is also available for offices and restaurants. The investment will be used for marketing and expansion.

Announced: 08/04/16 Stage: Series B Participating Institutional Investors: FJ Labs, Great Oaks Venture Capital, Riverhead Capital, Danhua Capital, GGV Capital, Global Founders Capital, Sound Ventures Previous Investment: $12.1 million Founded: February 2014

Drizly Raises $15m. The Boston, MA-based platform for alcohol delivery allows consumers to order beer, wine, and spirits for on-demand delivery. Consumers can also place orders with up to 48 hours for delivery by using Drizly Connect, which launched this summer. Drizly currently operates in 23 cities and has plans to expand to 30 by the end of this year. The funding will be used for marketing and to expand the team. In August it was also noted that spirits producer Diageo indirectly invested in Drizzly’s round last year via First Beverage Group.

Announced: 08/04/16 Stage: Series B Participating Institutional Investors: Polaris Partners Previous Investment: $17.8 million Founded: July 2012

City Pantry Raises $1.46m. The London, UK-based catering platform allows users to order food for office groups, events, and meetings. Users can choose from two offerings—a one-time event order or a subscription meal plan for recurring events. Food can be ordered from chefs, restaurants, and street vendors, and is delivered by City Pantry. The investment will be used for expansion in the UK and Europe.

Announced: 08/03/16 Stage: Seed Participating Institutional Investors: Angel CoFund, London Co-Investment Fund Previous Investment: Not Disclosed Founded: April 2013

Petoo Raises $500k. The Bangalore, India-based online restaurant delivers prepackaged Indian meals to consumers. The company also does food research to explore their food’s freshness and create methods for keeping food fresh without refrigeration or preservatives. Their food offerings include breakfast foods that stay fresh for 1 month, lunch and dinner products fresh for 3 months, and desserts fresh for 6 months. Petoo will use the funding for food research and implementing its new products.

Announced: 08/03/16 Stage: Seed Participating Institutional Investors: LetsVenture Previous Investment: $1.0 million Founded: 2015

Peek Raises $10m. The San Francisco, CA-based online platform allows users to find and book local tastings, activities and tours. The mobile-first platform features listings, reviews, and booking functionality for consumers, as well as Peek Pro, to help tour operators manage their business online and via mobile. The investment will be used to grow the company and team and to increase partnerships. In addition to the funding, Peek will partner with Yelp, so that companies can have consumers book directly from their Yelp pages.

Announced: 07/28/16 Stage: Series A Participating Investors: Pete Flint, David Bonderman, Ray Lane, Gigi Pritzker, Michael Pucker, Eric Schmidt, Jack Dorsey, Carl Sparks Previous Investment: $6.9 million Founded: 2012

Shipt raises $20m. The Birmingham, AL-based online grocery delivery service provides on-demand delivery in under 1 hour. Customers purchase a Shipt membership which allows them to place orders online or through a mobile app. Shipt currently operates in 27 cities in the southern United States, including cities in Florida, Alabama, Texas, North Carolina, South Carolina, Tennessee, Arizona, and Ohio. Shipt will use the funds to expand, develop grocery partnerships, and add alcohol delivery to its offerings.

Announced: 07/27/16 Stage: Series A Participating Institutional Investors: Greycroft Partners, e.ventures, Harbert Growth Partners Previous Investment: $5.2 million Founded: 2014

Good Eggs Raises $15m. The San Francisco, CA-based online grocery delivery service delivers organic and local meats, dairy products, and produce to consumers. After having to shut down out of state operations and fire 140 employees late last year, Good Eggs has found a second life, currently operating solely in the San Francisco region. The investment will be used to expand Good Eggs in the Bay Area and subsequently expand again throughout the United States.

Announced: 07/27/16 Stage: Series C Participating Institutional Investors: Index Ventures (lead), Obvious Ventures, S2G Ventures Previous Investment: $31.5 million Founded: July 2011

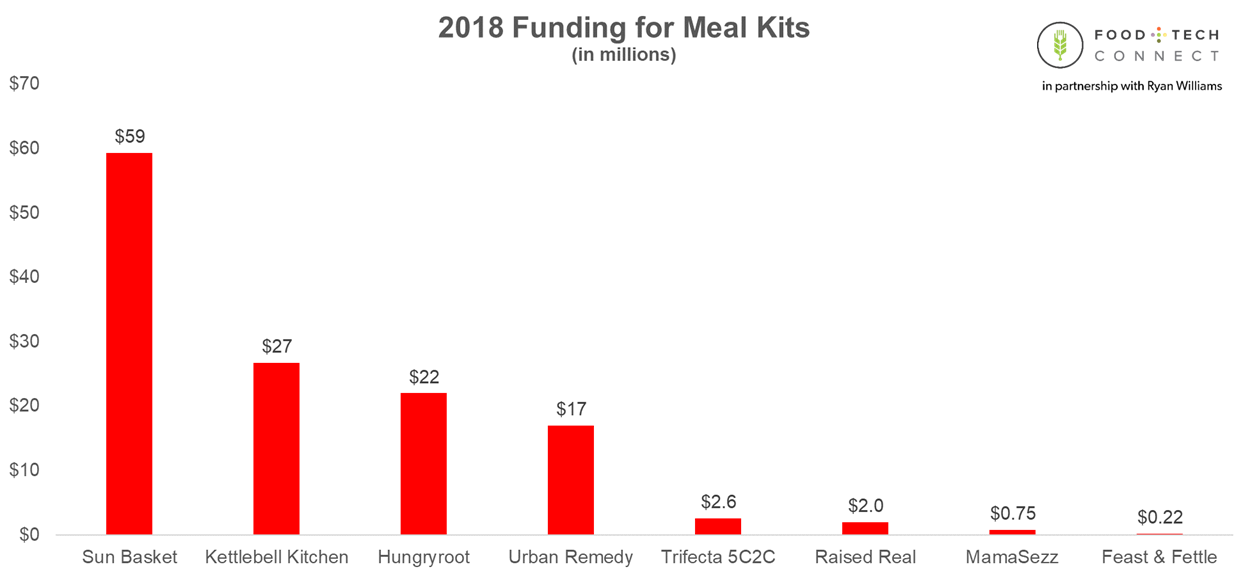

Sun Basket Raises $15m. The San Francisco, CA-based healthy meal kit delivery service offers organic meal kits with options for paleo and gluten-free diets. Kits come with simple recipes and ingredients that have been pre-portioned according to the recipe. Sun Basket aims to make organic products more accessible for consumers. The company currently serves 34 US states. They will use the investment to open a third distribution center, which will allow the company to reach 98% of the US—“more zip codes than the largest grocery store chain in the US.”

Announced: 07/26/16 Stage: Series B Participating Institutional Investors: Accolade partners (lead), Baseline Ventures, Founders Circle Capital, PivotNorth Capital, Relevance Capital, Shea Ventures, Vulcan Capital Previous Investment: $11.6 million Founded: April 2014

Innit Raises $18m. The Redwood City, CA-based connected kitchen platform uses technology, nutrition, and food science to make cooking easier. Innit smart kitchen products identify and measure food ingredients and suggests recipes and cooking techniques. The investment will be used to accelerate growth. The company recently announced partnerships with Good Housekeeping, Pirch and Whirlpool Corporation to enable advanced automated cooking on their kitchen appliances.

Announced: 07/21/16 Stage: Venture Participating Institutional Investors: Not Disclosed Previous Investment: $25.0 million Founded: September 2013

iFood Raises $30m. The Sao Paulo, Brazil-based online platform for food delivery allows consumers to order restaurant food for on-demand delivery. Users can place orders online or via mobile app. At present, iFood makes about 1.7 million deliveries per month. The ongoing strategic investment from Movile and Just Eat will help iFood expand into Mexico through SinDelantal, the largest food delivery service in Mexico, which was acquired by Just Eat in February. As the press release notes, iFood recently acquired Hellofood Brazil from JUST EAT and also acquired US-based SpoonRocket‘s technology, with plans to harness its logistics backend to optimize delivery time and enhance the restaurant-to-consumer experience.

Announced: 07/20/16 Stage: Series F Participating Institutional Investors: Movile, Just Eat Previous Investment: $61.9 million Founded: May 2011

Kiip Raises $12m. The San Francisco-based mobile rewards network, platform and app works with brands such as McDonalds and Pepsi to engage their audiences by rewarding them with free samples, special offers, virtual currency and other items during in-app events called “moments”. The company will use the funding to expand its sales and marketing efforts.

Announced: 07/19/16 Stage: Series C Participating Institutional Investors: North Atlantic Capital (lead), U.S. Cellular Previous Investment: $20.0 million Founded: July 2010

Zuppler Raises $300k. The Conshohocken, PA-based software producer provides software for restaurants that can be used to manage ordering and delivery. Currently, Zuppler’s software is used by over 1600 restaurants in the United States, Canada, Ireland, and the UK. The investment will be used to further develop its technology, point of sale and loyalty integrations, sales and marketing initiatives.

Announced: 07/18/16 Stage: Seed Participating Institutional Investors: SRI Capital Previous Investment: $1.6 million Founded: November 2008

LifeSum Raises $10m. The Stockholm-based digital health startup tracks what users eat as well as their exercise. The company has 15 million users and according to TechCrunch, is seeking partnerships with organizations in other sectors, including food, fitness, healthcare, DNA and pharmaceuticals. The company will use the funds to build out the team and product development as it expands in Europe and the United States.

Announced: 07/18/16 Stage: Series B Participating Institutional Investors: Nokia Growth Partners (lead), Bauer Media, Draper Esprit, SparkLabs Global Ventures Previous Investment: $6.7 million Founded: November 2008

Benchmark Intelligence Raises $500k. The Fresno, CA-based restaurant analytics startup aids restaurant and retail chain owners in understanding why certain locations perform better than others. According to Fresno Business Journal, Benchmark Intelligence collects data from three main sources — voice-of-the-customer SMS text messaging surveys, social media reviews and field study audits. The company will use the funds to build out the team.

Announced: 07/15/16 Stage: Seed Participating Institutional Investors: San Joaquin Capital Previous Investment: $70k Founded: August 2014

Twigly Raises $600K. The Guragon, India-based online meal delivery service allows consumers to order fresh meals for on-demand delivery. The menu is updated weekly and all meals are prepared at Twigly’s own central kitchens. Presently, Twigly operates 2 kitchens in Guragon and delivers 150 orders per day. With the investment, the company plans to expand to Delhi and Bangalore and deliver 1000 orders per day.

Announced: 07/13/16 Stage: Seed Participating Investors: Tracxn labs (lead), Gaurav Bhalotia, Hyderabad Angels, Kunal Shah Previous Investment: $0.2 million Founded: August 2015

Jumbotail Raises $2m. The Bangalore, India-based online food and groceries marketplace provides a platform for wholesalers to sell their products and services online. According to Deal Street Asia, Jumbotail works with wholesalers in India using technology, data science and design and employs approximately 50 people.

Announced: 07/13/16 Stage: Seed Participating Institutional Investors: Nexus Venture Partners Previous Investment: Not Disclosed Founded: November 2015

Freshly Raises $21m. The New York, NY–based meal delivery service provides fully prepared healthy meals. Users create a weekly subscription and select meals from Freshly’s menu options. All meals are delivered at the start of the week ready to be reheated. Freshly currently delivers 250,000 meals per month to consumers in 28 states. The funding will be used to expand to all 50 U.S. states and to agressively grow its technology team.

Announced: 07/12/16 Stage: Series B Participating Institutional Investors: Insight Venture Partners (lead), Highland Capital Partners, Slow Ventures, White Star Capital Previous Investment: $9.0 million Founded: January 2012

Holachef Raises $1.95m. The Mumbai, India-based mobile and web app allows users to order chef-cooked meals for on-demand delivery. Holachef’s menu is changed daily, offering about 50 choices each day. Currently, the company delivers 100,000 orders per month.

Announced: 07/08/16 Stage: Venture Participating Institutional Investors: Kalaari Capital (Lead), India Quotient Previous Investment: $3.4 million Founded: 2014

Quickli Raises Bridge Funding. The Guragon, India-based mobile app allows consumers to place orders for delivery. Users can order food, groceries, and healthcare/pharmaceutical products. All orders are delivered on the same day they are placed. Quickli currently operates in Delhi and fills 2000 orders per day. The company will use the funding to expand to new locations, including Bangalore.

Announced: 07/07/16 Stage: Venture Participating Institutional Investors: 500 Startups, AVG Group Previous Investment: Not Disclosed Founded: April 2015

BevSpot Raises $11m. The Boston, MA-based mobile platform allows businesses to easily manage liquor and alcohol sales and inventory. BevSpot is currently used by over 400 companies in over 40 of the United States. These include restaurants, bars, nightclubs and hotels. The investment will be used for product development and expansion.

Announced: 07/07/16 Stage: Series B Participating Institutional Investors: Bain Capital Ventures Previous Investment: $6.1 million Founded: March 2014

Cookoo Raises $300k. The London, England-based meal delivery service offers healthy, home-cooked meals for delivery. All meals come ready-to-eat and microwave re-heatable. The investment will be used to add more cooks and expand Cookoo’s offerings.

Announced: 07/05/16 Stage: Seed Participating Institutional Investors: Not Disclosed Previous Investment: Not Disclosed Founded: 2016

Grab Raises $2m in Debt Financing. The Mumbai, India-based logistics services platform provides delivery services for restaurants, food tech platforms, groceries, ecommerce platforms, and banks. To date, Grab has made over 5 million deliveries for over 12 thousand merchants in 10 cities. The funds will be used to further develop its technology and roll out additional service verticals.

Announced: 07/04/16 Stage: Debt Financing Strategic Investor: Aramex Ventures Previous Investment: $1.0 million Founded: 2012

ProducePay Raises $2.5m. The Los Angeles, CA-based online platform for payment solutions connects farmers with cash flow earlier in the farming and distributing process than other payment methods. Instead of having to wait for produce to be distributed and sold to receive payment, farmers are able to receive payment the day after produce is shipped. To date, ProducePay has financed $80 million of produce from farmers in the United States, Mexico, Chile, and Honduras.

Announced: 06/29/16 Stage: Seed Participating Institutional Investors: Menlo Ventures, Arena Ventures, CoVentures, Red Bear Angels, Social Leverage Previous Investment: $1.4 million Founded: December 2014

Ancera Raises $8.9m. The Branford, CT-based food safety technology company develops hardware and software to test food for contaminants such as salmonella and e.coli. Ancera’s product Piper is a small instrument that can detect salmonella a food sample within 1 to 8 hours. This contrasts with tradition testing methods which can take up to 5 days. The funds will be used for hiring, commercial production and distribution of products, and for research to create products to detect other food contaminants like e.coli.

Announced: 06/28/16 Stage: Series A Participating Institutional Investors: Glass Capital Management (lead), Bulldog Innovation Group, Metabiota, Packers Sanitation Service Previous Investment: $1.3 million Founded: 2012

Farm Hill Raises $3m. The Redwood City, CA-based meal delivery service provides healthy meals to companies and office workers. Customers can order individually or as an office group, with a lower delivery payment rate for group orders. Farm Hill makes and distributes all of its meals, and includes options for all diets (including paleo, vegetarian, vegan options). Farm Hill currently operates in Silicon Valley. The investment will be used for expansion to San Francisco, as well as for new technology to make delivery and kitchen operations more efficient.

Announced: 06/27/16 Stage: Venture Participating Investors: Eagle Cliff Partners, Liberty City Ventures, Soma Capital, StartX, Zalmi Duchman Previous Investment: $1.0 million Founded: June 2013

Thrive Market Raises $111m. The Los Angeles, CA-based online organic grocery store offers wholesale organic foods. Users pay an annual membership fee to purchase from Thrive, while the company offers a free membership to a low-income family for each paid membership on the site. The company plans to use the funding for growth—expanding infrastructure, marketing, and creating new written and video content.

Announced: 06/27/16 Stage: Venture Participating Institutional Investors: Invus, Cross Culture Ventures, e.ventures, Greycroft Partners Previous Investment: $58.0 million Founded: 2013

FareWell Raises $8.5m. The San Francisco, CA-based online program for lifestyle and diet intervention seeks to help people with elevated body mass indexes or chronic weight-related diseases. The 16-week program includes a diet program with video tutorials, meal plans, shopping lists, and plant-based recipes. In addition, participants have access to health coaches, physicians, chefs, behavioral psychologists, and dieticians through the program. The funds will be used to launch the pilot program.

Announced: 06/23/16 Stage: Venture Participating Investors: David Perry Previous Investment: Not Disclosed Founded: May 2015

Eunoia Raises $800k. The Singapore-based restaurant tech platform, Ordr, allows food and beverage businesses to view information from 3rd party apps for menus, ordering, and payment in one consolidated layout. The restaurant can easily process orders and update and sync menus. The technology serves both to combat labor shortage in Singapore with the use of automation and to make serving customers more efficient, mobile-friendly, and profitable.

Announced: 06/17/16 Stage: Seed Participating Institutional Investors: Golden Equator Capital Previous Investment: Not Disclosed Founded: 2015

CaterWings Raises $6.7m. The London, England-based online catering platform connects businesses with caterers. CaterWings currently operates in Amsterdam, Berlin, Hamburg, London, and Munich. The investment will be used to expand to additional cities in Europe as well as to expand CaterWings’ online presence and improve customer service.

Announced: 06/16/16 Stage: Venture Participating Institutional Investors: Tengelmann Ventures, Rocket Internet, HV Holtzbrinck Ventures Previous Investment: Not Disclosed Founded: 2015

Qloo Raises $4.5m. The New York, NY-based local and cultural discovery platform provides users with recommendations based on their personal preferences. Recommendations encompass 8 categories, including: dining, nightlife, fashion, books, music, film, television, and travel. The investment will be used to increase Qloo’s database and add clients.

Announced: 06/15/16 Stage: Series A Participating Investors: Barry Sternlicht, Adriaan Ligtenberg, Leonardo DiCaprio, Pierre Lagrange Previous Investment: $3.0 million Founded: April 2011

Ava Raises $3m. The Boston, MA-based mobile nutrition coach app allows consumers to track food consumption and receive personalized nutritional feedback. Users take a picture of the food they eat and text it to Ava to receive health information. Caloric value is calculated using image recognition software. The investment will be used to develop technology and expand Ava’s nutrition science team.

Announced: 06/14/16 Stage: Seed Participating Institutional Investors: DCM Ventures (lead), Innovation Endeavors, Khosla Ventures Previous Investment: Not Disclosed Founded: 2016

Khanagadi Raises Undisclosed Funding. The Jaipur, India-based mobile app allows train commuters to order food for on-train delivery. Khanagadi currently operates in 200 railway stations in India, and serves 100 to 150 orders per day. Khanagadi will use the funding for expansion, marketing, and hiring.

Announced: 06/11/16 Stage: Seed Participating Institutional Investors: 50KVentures Previous Investment: Not Disclosed Founded: 2015

Door to Door Organics / Relay Foods Raises $10m. In connection with the merger, the combined company received additional funding from Door to Door Organic’s previous investor, The Arlon Group.

Announced: 06/08/16 Stage: Growth Participating Institutional Investor: The Arlon Group

Ordermentum Raises $2.5m. The Sydney, Australia-based B2B order management platform allows food and beverage retailers to manage and place orders with suppliers. Suppliers can also use the platform to receive and manage orders and payment. Currently, Ordermentum is used by over 3000 businesses in Australia. The investment will be used to grow the company.

Announced: 06/07/16 Stage: Series A Participating Institutional Investors: Capital Markets Technologies Previous Investment: Not Disclosed Founded: July 2014

SevenFifty Raises $8.5m. The New York City-based online wholesale platform for alcohol distributors is focused on modernizing and streamlining the wholesale alcohol supply chain by connecting the beverage alcohol industry with a platform that helps distributors and buyers interact.

Announced: 06/01/16 Stage: Series A Participating Institutional Investors: Formation 8, Pritzker Group Venture Capital Previous Investment: Not Disclosed Founded: 2012

WISErg Raises $4m. The Issaquah, WA-based technology producer provides restaurants and grocery stores with a simple, sustainable method to recycle food scraps. WISErg’s Harvester machine uses collected scraps of food to make a liquid fertilizer for agricultural farmers. In addition to creating fertilizer, the machine collects and reports data on what foods are thrown away that stores can use to manage their products. The funds will be used to scale operations on the west coast.

Announced: 06/01/16 Stage: Series B Participating Institutional Investors: Not Disclosed Previous Investment: $44.6 million Founded: September 2009

PARTNERSHIPS

Ibotta Partners with Button, Jet, and Doordash to offer in-app purchases.

Toast Partners With Chowly to integrate online ordering systems with restaurant point of sale systems.

Square Partners with TouchBistro and Vend to increase payment and point of sale options for restaurants.

Olo Partners with Conversable to offer online ordering through messaging apps.

Yelp Partners with Nowait (and invests $8m) to add restaurant wait times and waitlists to its offerings.

Square Partners with Upserve to offer loans to small businesses in the restaurant industry.

TouchBistro Partners with 7Shifts to simplify restaurant employee scheduling and management.

Google India Partners with Zomato and Swiggy to allow consumers to order from restaurants directly from their Google search or app.

Instacart Partners with Food Network to deliver groceries and recipe ingredients.

Publix Partners With Instacart to deliver groceries in Miami.

PlateJoy Partners with Instacart to make recipe ingredients available via delivery.

Sprouts Farmers Markets Partners with Amazon Prime to deliver fresh groceries in under one hour.

Marley Spoon Partners with Martha Stewart to deliver meal kits with ingredients and directions for Martha Stewart’s recipes.

RedBrick Partners with Monj to provide information about food and behavioral change for people with prediabetes and chronic conditions.

HookLogic Partners with Instacart, Fresh Direct, and Drugstore.com to increase digital sales and marketing of consumer packaged goods.

Uber Partners with Foursquare to allow users to find locations by name instead of street address.

Retail Control Systems Partners With Toast to provide an all-in-one software for a restaurant management and point-of-sale system.

Chowly and Revel Systems Partner to connect online restaurant orders with restaurant point-of-sale systems.

foodjunky.com Partners with Yelp to provide online ordering and delivery directly from Yelp pages.

Monsanto Partners with Microsoft to fund agricultural technology development in Brazil.

Stuart Partners with Just Eat to offer on-demand delivery services and drivers to restaurants.

Alibaba Partners with Menusifu to begin use of mobile payment app Alipay in the United States.

Zomato Partners with Helpchat to offer in-app online food ordering.

Peek Partners with Yelp to offer booking directly through Yelp platform.

Cisco Partners with H-FARM to launch a food tech accelerator.

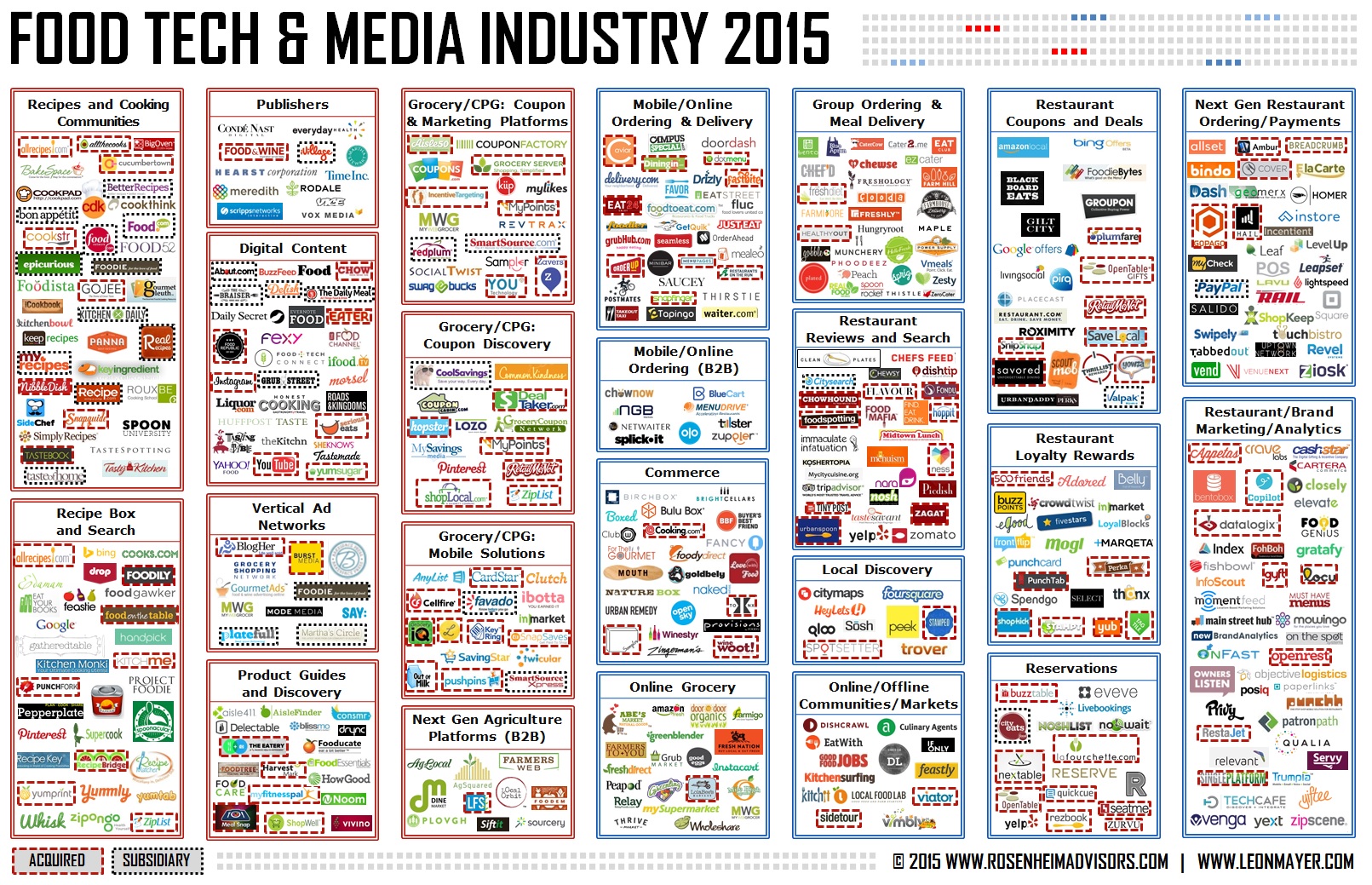

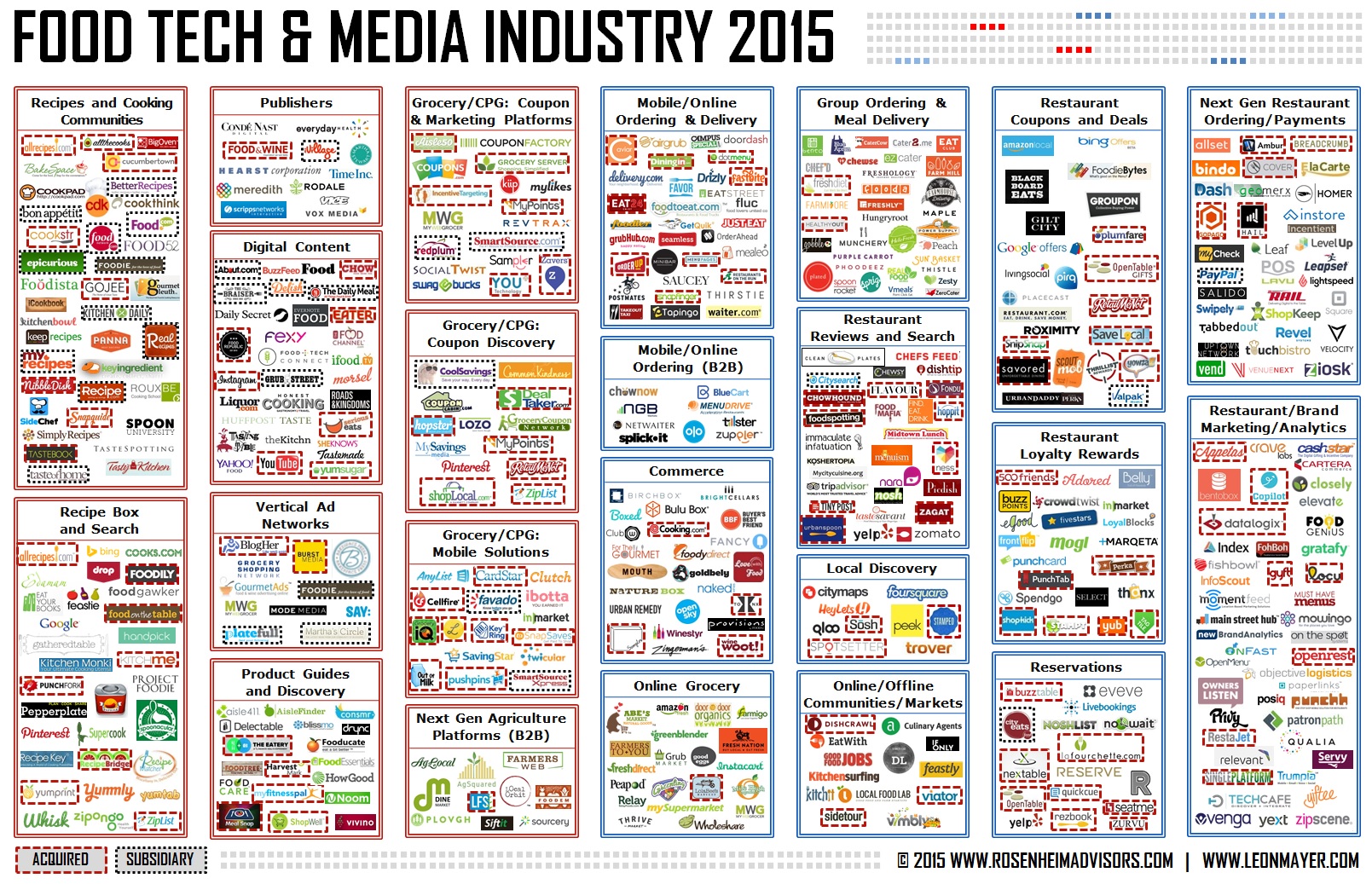

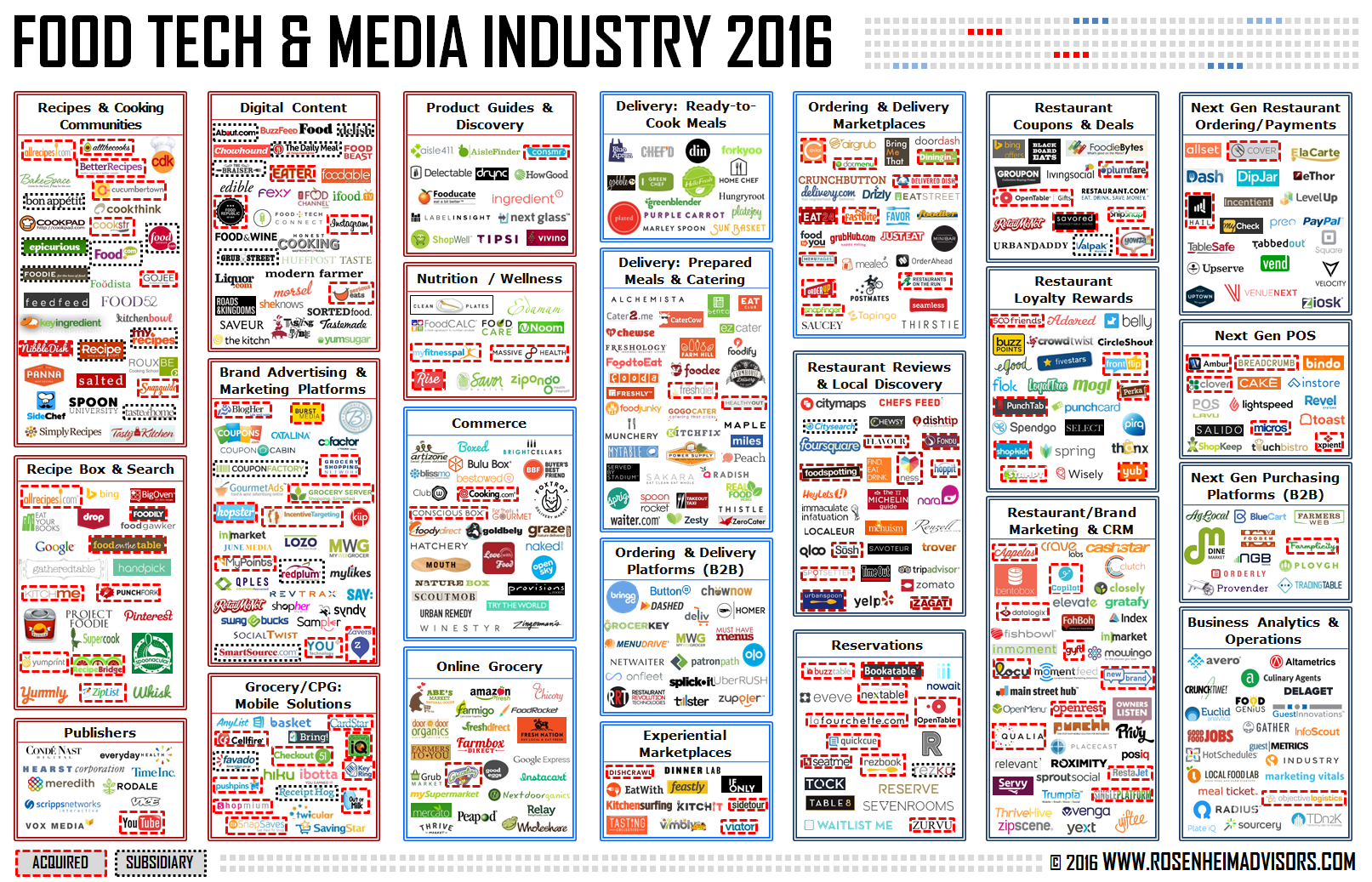

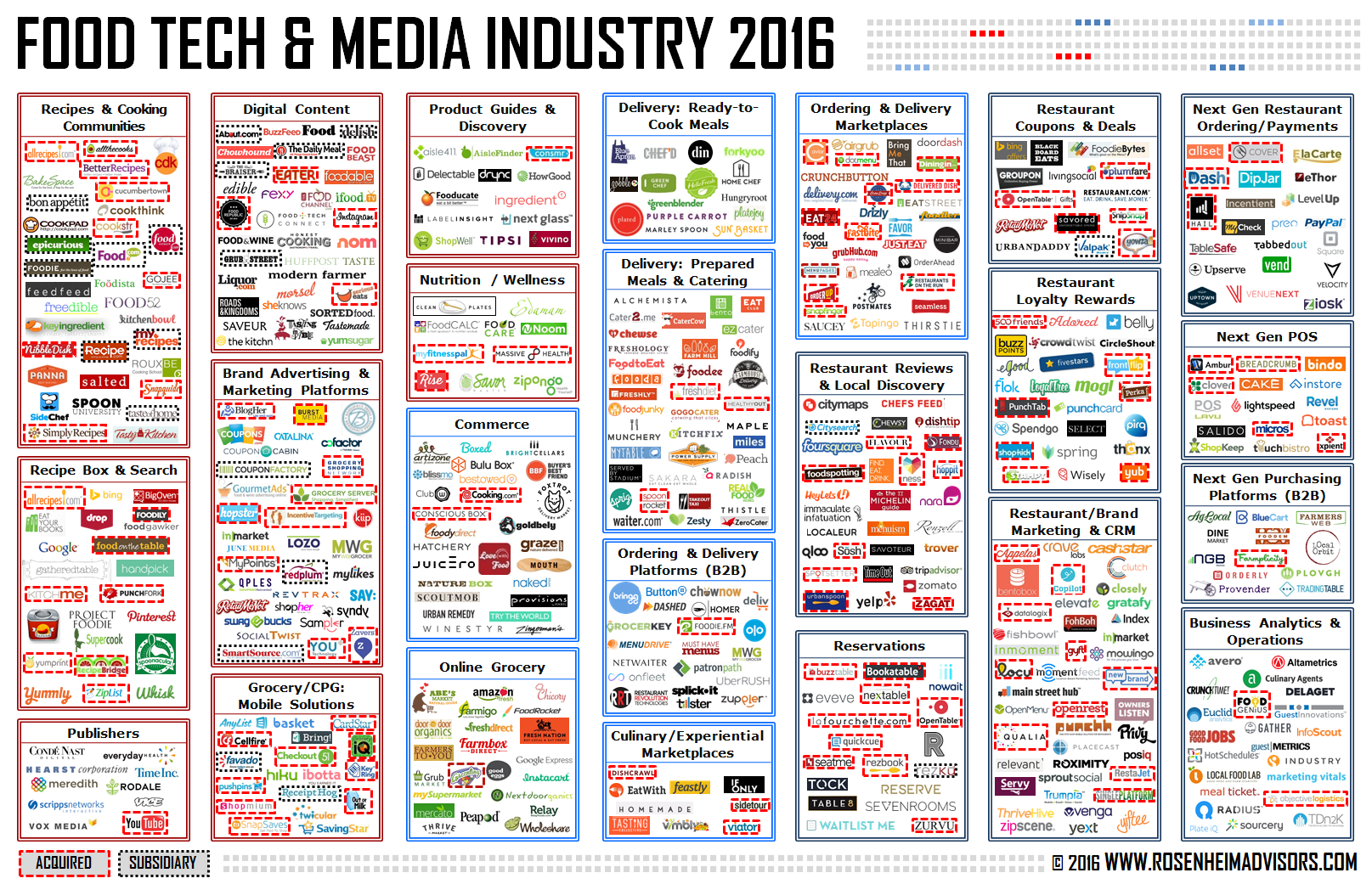

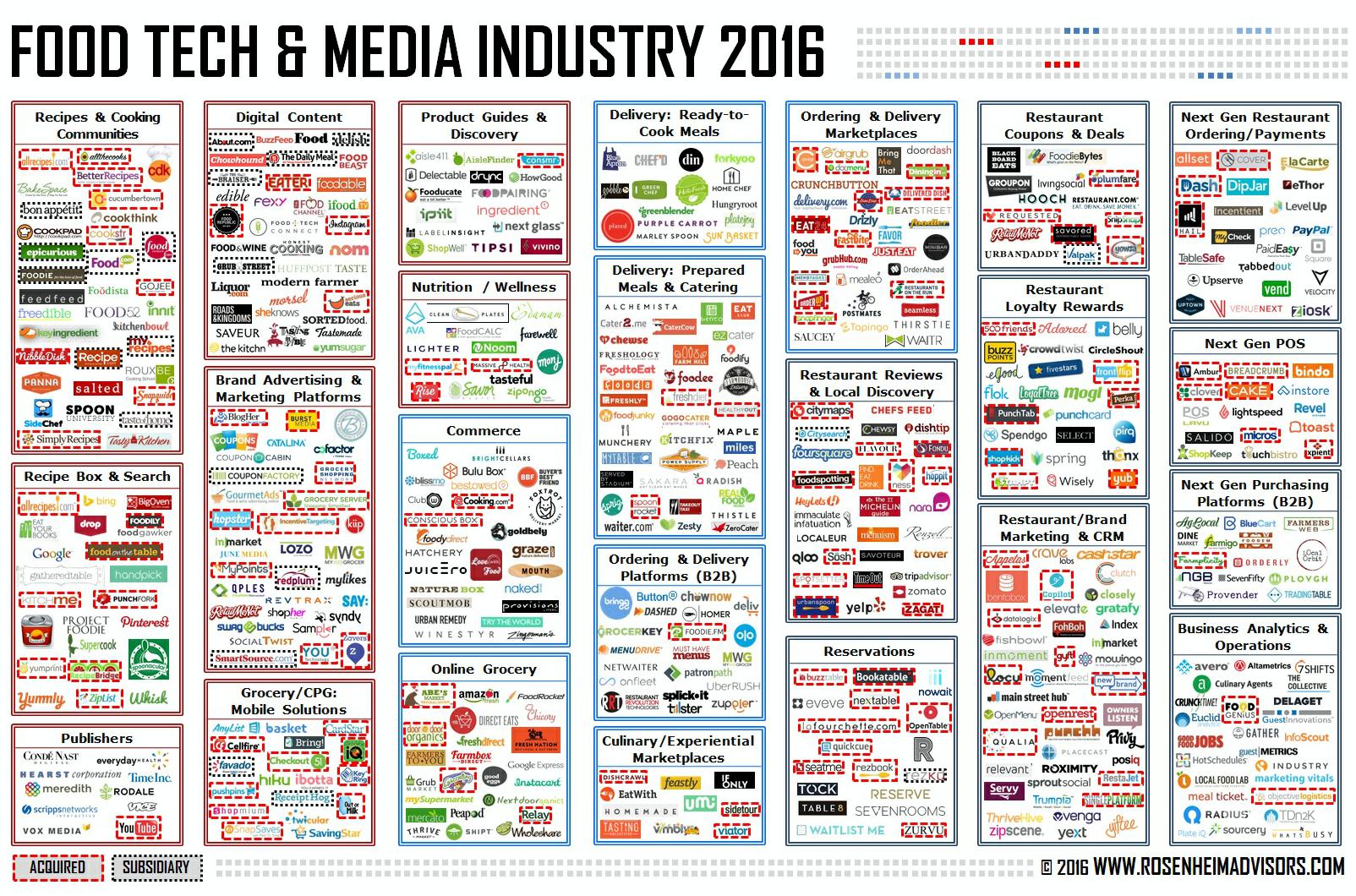

INDUSTRY LAANDSCAPE

As the Food Tech & Media ecosystem continues to see rapid change, Rosenheim Advisors created The Food Tech & Media Industry Map to help entrepreneurs, participants and investors understand this quickly evolving landscape. Let us know about your recent or upcoming funding, partnerships or acquisitions here.

The post Food Tech Media Startup Funding, M&A & Partnerships: Summer 2016 appeared first on Food+Tech Connect.